You Think The Rich "Cheat" Taxes - Why You Wrong

Welcome to 'Why You Wrong,' a podcast & newsletter dedicated to unmasking the broken status quo and all the myths, lies, half-truths, manipulated stats, and crony beliefs that are used to justify bad policies, wrong actions, and unintended—yet real—consequences.

Today’s topic covers a class struggle that’s been going on since the dawn of civilization—the rich, taxation, power, the state, and control.

We debunk the terrible lies that so many average people readily accept and show how these bad policies end up causing the reverse of their intended effect.

Note: The following applies to the last 150 years and mainly pertains to America, where we’ve had a mostly free market (though less in recent years). These ideas do not apply to previous historical periods or other jurisdictions and nations. However, these concepts apply to most liberal democracies that tax citizens and give those funds to bureaucrats to dole out.

The Origin of This Project

One day I was scrolling Twitter and came across this tweet from Biden. I don’t follow him, but the algorithm decided to serve it up to me. (I usually retweet and make fun of the original tweet.)

ttps://twitter.com/potus/status/1660344707489169408?s=46&t=Taj8pBcShbQXzkSHwUyiUA

https://twitter.com/morebetterhuman/status/1660485475965054976?s=46&t=Taj8pBcShbQXzkSHwUyiUA

https://twitter.com/morebetterhuman/status/1660483905256931329?s=46&t=Taj8pBcShbQXzkSHwUyiUA

https://twitter.com/MarkRuffalo/status/1665161265411391488

I’ve seen some variation of this tweet from the sitting US President at least a few times. I thought to myself, “People still buy this nonsense?” 🤔

Apparently they do since he and the other socialist fools (Warren, Snaders) keep using it.

Then I thought about a resource that could take an idea/narrative/belief like this and provide so much information—I’m talking your finger starts hurting from all the wheel scroll action—that people could send others to in the hopes of helping them see through the propaganda. Just badger them over the head with fact after fact after chart after chart. Maybe that’d help.

Then it would make for a good podcast.

So here we are. I created it.

Other topics I’m going to tackle include:

Do you think red meat causes heart disease

Do you think salt causes hypertension

Do you think skin color matters

You think monogamy is “normal” or even “natural.”

Do you think democracy is good or that America is a democracy

You think the state is “normal” or “natural.”

This is a place for truth, whether politically incorrect or inconvenient.

This is where I will challenge many liberal ideas because, generally, those ideas are wrong (anything that is more government is default-bad/wrong).

This is a place where you’ll at least see another side. You don’t have to agree with it. And if you do, that doesn’t matter either, because this is where agreeing with others’ ideas means nothing, so stop pretending it does.

You like to agree because it feels good. it lights up your dopamine receptors because agreeing with what you perceive as your “tribe” is a survival mechanism passed down to you from your ancestors. And we all have it.

But when it comes to ideas, that should not matter. The only thing that matters is empirical physical reality and whether something works or doesn’t work. If something works better, it is better, not necessarily the best. Just better. And that is always

Why the rich aren’t tax cheats

The rich don’t cheat on their taxes because they don’t have to. They hire experts and advisors that show them legal ways to pay as little tax as possible. (They still pay taxes since it’s impossible to be wealthy and not pay taxes, as the following will show you.)

They also have more to lose, so cheating doesn’t have enough ROI to justify it. I

Yet you see tweets like this from Biden (I’d expect nothing less):

insert tweet here.

Wealthy tax cheats, he says.

The average person buys into this narrative because it feels good, sounds good, and sounds like it’s probably right. After all, most people think the rich cheated, stole, or got their wealth by doing something immoral or illegal.

Today I hope to dispel all these misconceptions by providing common sense logic supported by cold, hard facts.

Some of what we’ll cover:

How the rich pay most of the taxes

How paying as little tax as possible is the moral thing to do (and why paying more is immoral)

No matter how much tax revenue the government generates, there will never be a balanced budget. Never again.

How inflation robs us all, and still the state will never balance its books. Never ever.

Example of how the US government wastes BILLIONS of dollars every year.

And more.

I hope by the end of this piece you’ll never again fall for this blatant lie that’s nothing more than propaganda and has zero basis in reality.

High-income earners pay the MAJORITY OF FEDERAL INCOME TAXES

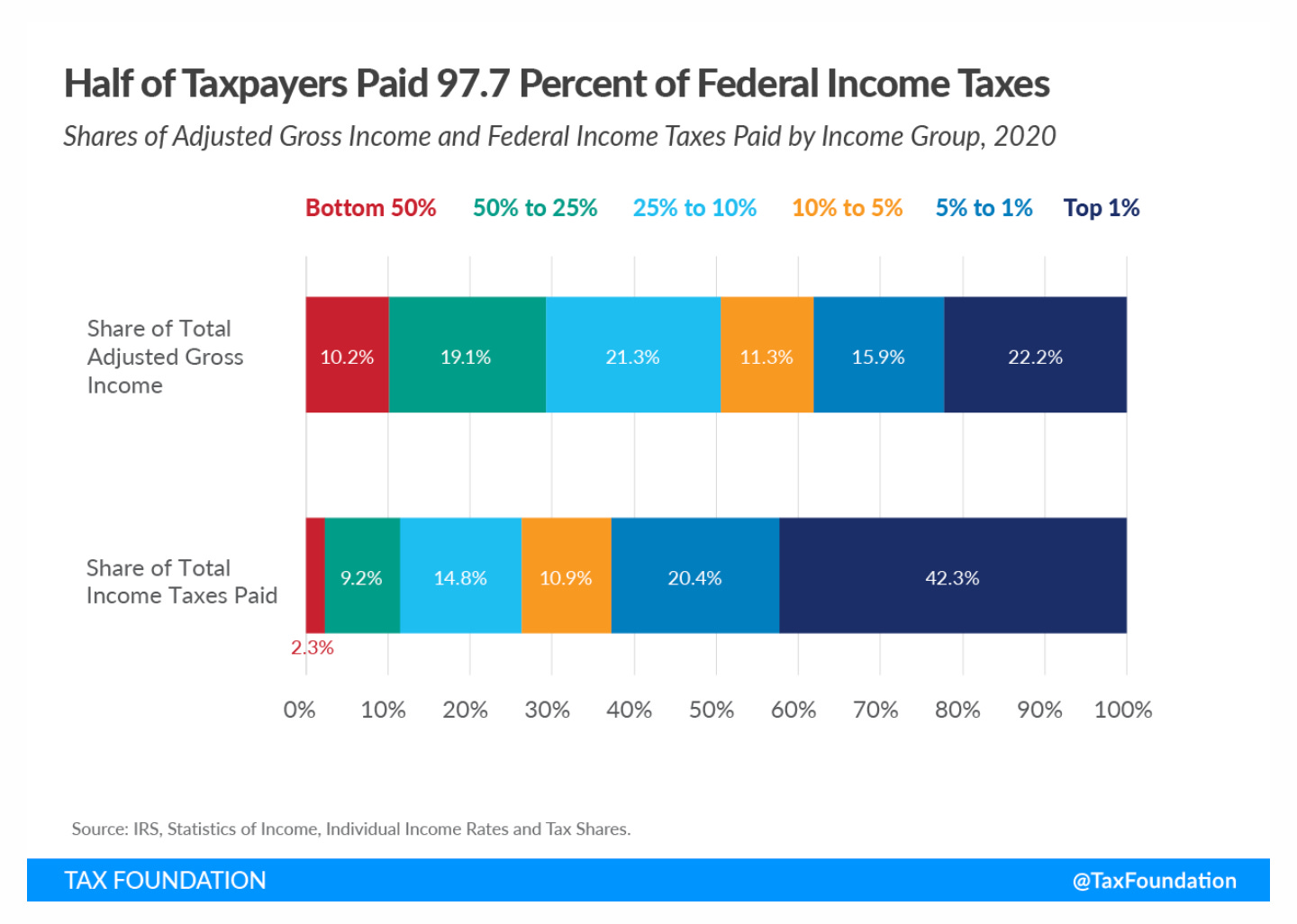

In 2020, the bottom half of taxpayers earned 10.2 percent of total AGI and paid 2.3 percent of all federal individual income taxes. The top 1 percent earned 22.2 percent of total AGI and paid 42.3 percent of all federal income taxes. source

The rich pay more taxes than everyone else. So the idea that they should pay more than is legally required is stupid and immoral. Why immoral? Because giving the government more money directly correlates to more dead women and children through the US government's many shadow wars, dictator disposing of, regime change, and other Big Superpower Bully actions it's taken on since WW2.

Simply put, more money in the hands of bureaucrats, the CIA, FBI, and other three-letter agencies will result in more innocent innocents and even more suffering at the hands of the growing abomination of the US government.

The Wealthy Are Business Owners

According to Vanguard, the asset allocation of a typical millionaire household is:

65% Stocks (Equity)

25% Bonds (Fixed income)

10% Cash

These assets consume - and pay taxes on every dollar consumed. They produce and are taxed on every dollar of profit form production. Then the consumers of these products pay a consumption tax.

Types of investments/businesses

Stocks → Cap gains on any dividends or sale → 20% of that will end up in the hands of the state, possibly more if they die. Here’s a calculator to show you some numbers.

Bonds → 20% of that income paid by businesses or municipals (state-run businesses)

Real estate → Yearly taxes to the state then 20% of all income/sale profits

Businesses → Each business pays a mountain of taxes. See above. Employees. They collect taxes from the consumer for the states where the sale is made. Tariffs, fees, regulations, and duties. On and on it goes.

Every single one of these assets is taxed. Real estate is taxed every year you own it, regardless of whether it makes any money. Same with certain tangible property taxes. All income is taxed. And any sale is taxed.

They are taxed, and there is no avoiding it.

So to say the wealthy don’t pay taxes is laughable, wrong, and an outright lie.

A $10,000,000 example

A retired investor. He takes no salary or payroll. He lives off his investments.

He has $10,000,000 in investments that break down like this

$1,000,000 in cash

2,500,000 in real estate

5,000,000 in stocks (some produce dividends)

$1,5000,000 in hard assets and commodities (bitcoin, gold, silver, oil)

His monthly investment income is $45,000 and is taxed at 20% (capital gains).

That’s $9,000 a month he pays in federal income taxes. Then there’s sales tax and maybe state income tax.

Whenever he sells one of his stocks, he is taxed at 20%. If he sells a property, he is taxed at 20%.

Each of his investments pays out all kinds of taxes, whether running a real estate business, a company, etc., and each one of these cash-producing businesses generates ongoing tax liabilities, all of which payout to the state and federal governments.

The rich hold most of their wealth in assets. They don’t sit on mountains of cash because inflation would eat it away, just like the rats ate so much of Escobar’s cash.

Since these assets are value-creating, cash-producing business enterprises, they all pay their taxes. Then, when profits are distributed to the owners, they pay taxes. So on and so forth, and infinite.

THE TRUTH ABOUT WEALTH AND TAXES: It’s impossible to be rich and not pay millions in taxes. This is not hyperbole. It’s a mathematical certainty. You can’t escape it. It’s impossible. Today, you’ll see why.

This idea that the rich pay no taxes and “cheat” is one of the grossest narratives of our time because of HOW WRONG IT REALLY IS.

And this is how it works for EVERY WEALTHY PERSON IN THE WORLD.

They own businesses and pay taxes on the profits they generate from those businesses. The businesses also pay bucketloads of taxes, fees, regulations, etc.

When someone says the rich don’t pay taxes, they are lying.

There is not a single rich person alive who isn’t paying taxes.

The Founding Fathers are turning in their grave

Our Founding Fathers weren’t big fans of the income tax. In fact, it wasn’t until 1913 that the 16th Amendment was ratified, allowing the federal government to directly tax the incomes of individual Americans. The ensuing Revenue Act of 1913 called for a tax that ranged from a modest 1 percent on incomes exceeding $3,000 to 7 percent on incomes exceeding $500,000. It wasn’t long before a policy of “taxing the rich” significantly more than everyone else was implemented. In order to pay for World War I, Congress passed a law in 1916 that raised the tax rates on incomes over $300,000 to 70 percent. source

Tax brackets

For the 2021 tax year, the federal tax brackets for individual income tax rates:

10% on income up to $9,950 for single filers ($19,900 for married couples filing jointly).

12% on income over $9,950 and up to $40,525 ($19,900 to $81,050 for married couples filing jointly).

22% on income over $40,525 and up to $86,375 ($81,050 to $172,750 for married couples filing jointly).

24% on income over $86,375 and up to $164,925 ($172,750 to $329,850 for married couples filing jointly).

32% on income over $164,925 and up to $209,425 ($329,850 to $418,850 for married couples filing jointly).

35% on income over $209,425 and up to $523,600 ($418,850 to $628,300 for married couples filing jointly).

37% on income over $523,600 ($628,300 for married couples filing jointly).

The U.S. uses a progressive tax system, so higher income levels are taxed at higher rates. For example, a single filer with an income of $100,000 would pay a 10% tax on the first $9,950 of income, a 12% tax on income between $9,950 and $40,525, a 22% tax on income between $40,525 and $86,375, and a 24% tax on income between $86,375 and $100,000.

Capital Gains Taxes

Capital gains tax is applied to the profits from selling assets like stocks, bonds, businesses, machinery, commodities, or real estate. In the United States, capital gains tax rates depend on how long you've held the asset and your income. The rates are divided into short-term and long-term categories:

Short-term capital gains are usually taxed at the same rate as your regular income. These gains come from assets held for one year or less. So, the tax rates on these gains for 2021 would be the same as the regular income tax rates, which I mentioned in the previous response.

Long-term capital gains are generally taxed at lower rates. These gains come from assets held for more than one year. For 2021, the long-term capital gains tax rates were:

0% for single filers with taxable income up to $40,400 ($80,800 for married couples filing jointly).

15% for single filers with taxable income over $40,400 and up to $445,850 ($80,800 to $501,600 for married couples filing jointly).

20% for single filers with taxable income over $445,850 ($501,600 for married couples filing jointly).

In addition to these rates, high-income taxpayers might also owe the 3.8% Net Investment Income Tax. Also, certain types of assets might be subject to different tax rates.

Simply put, every dollar of profit the rich make through investments is taxed at 20%. (It’s mathematically impossible to be rich and not pay taxes.)

State Income Tax

Have you ever wondered why the states with the highest income taxes (California and New York) have the shittiest run cities with the most problems? Who woulda thought that giving MORE money to politicians would actually make things worse? 🤔

California around 10.25% + income tax

NY sales tax - 8.87

90% Tax lol

This just showed up in my feed.

Anyone who actually cares to research whether this works knows that this drives tax revenue down... and with it innovation, investment, jobs, the future. the fastest way to destroy America would be this nonsense.

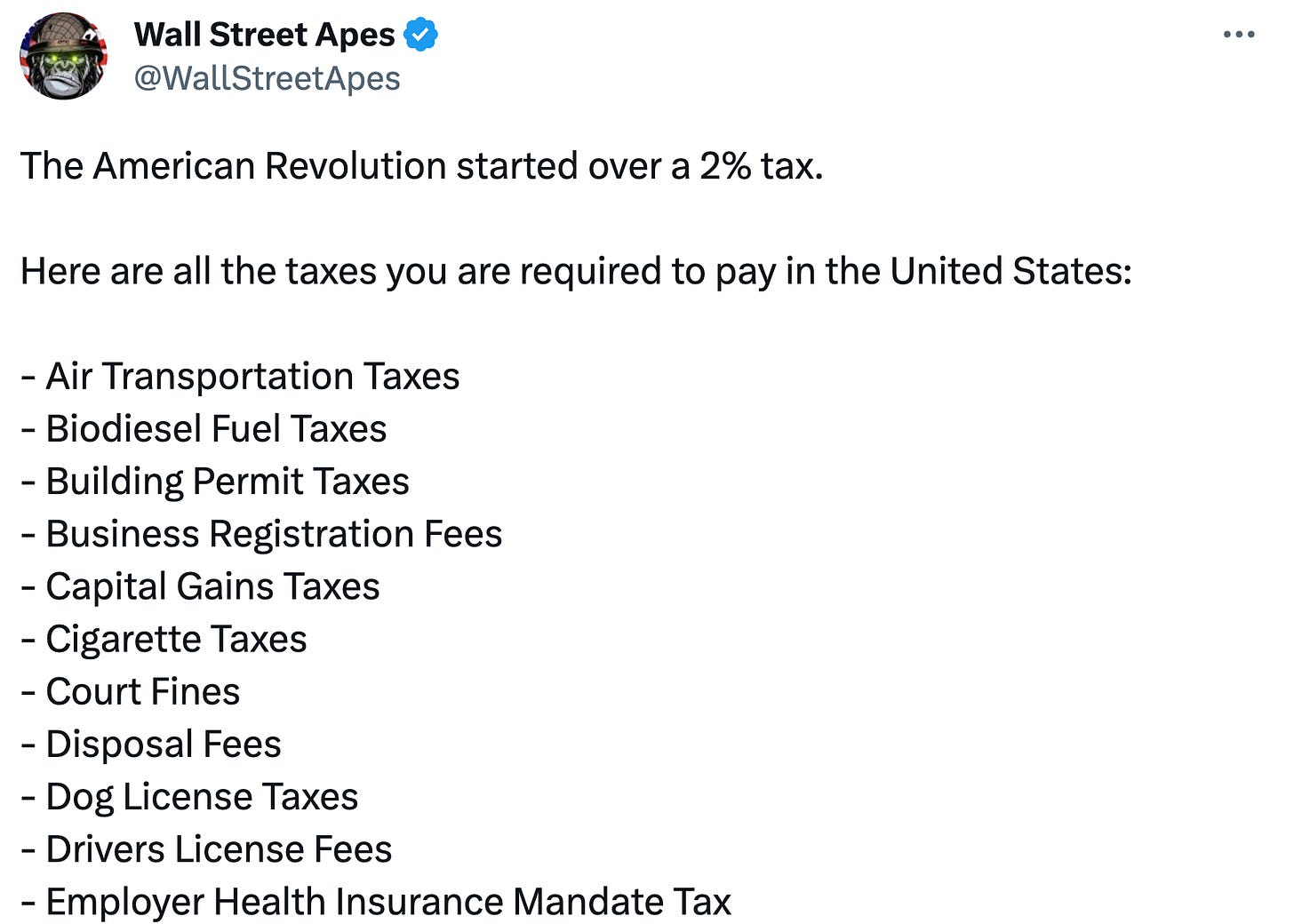

97 different taxes in the US tax code

Modern tax code: You're taxed when you make it, sell it, buy it, spend it, lose it, find it and die with it.

97 taxes in the US code https://paradigmlife.net/ready-to-get-depressed-how-many-different-taxes-do-i-pay

Self-employment tax

Employer tax

Tariff (taxes on international trade)

sales tax EVERY SINGLE THING A COMPANY BUYS (some exceptions) require a sales tax

Federal income tax withholding from employee pay

FICA taxes for Social Security and Medicare, paid by both employees and employers - so whatever you pay as an employee, I have to match that.

Federal unemployment (FUTA) taxes, paid by employers

Capitation, a fixed tax charged per person

Excise tax - using fuels or transportation of communication.

Effective taxes, government policies that are not explicitly taxes, but result in income to the government through losses to the public

Gift tax

inheritance tax

death tax

On The Stupidity of Federal Income Taxes

Everything the State says is a lie, and everything it has it has stolen.

-Nietzsche

The government DOES NOT PRODUCE OR PAY FOR ANYTHING. It is a parasite.

So who pays?

We do.

The productive members of society who create wealth. We create, and the state feeds off our productivity like a leech.

We pay for the bombs that kill women and children. The politicians call it "defense," as if we needed to invade a country in the name of "freedom." What a crock of shit.

We pay for shadow wars that kill countless innocent civilians and line the pockets of the military-industrial complex.

We pay for the state's reckless and incompetent spending. And still, with trillions, the government can’t balance its budget. (And it won’t no matter how much it brings in.)

The Democratic answer is to spend more, tax more, and create a bigger state, but what will that do?

The Republican answer is to spend less, which is a start but will still never be enough.

Democrats, Taxation, and Theft

The Democratic playbook is theft—taking from others, giving to others, and getting power by promising to do so.

The left claims moral superiority using the "rich are evil" rhetoric and words like "those in need."

Do you remember the communist motto?

"From each according to his ability, to each according to his needs," popularized by Karl Marx.

In case you need to brush up on your history, communism is directly responsible for over 100 million human deaths over the last 100 years. More than both world wars combined.

Do you know why these ideologies gained so much traction with the average person and why the Democrats still use them to garner support today?

Because it appeals to two aspects of human nature:

The desire to take from others, especially those we perceive as above us (it's not fair, fierce egalitarianism)

Free stuff, legal theft without having to do anything to get it other than vote.

Democrats have a long history of gaining power by pledging to steal from others in the name of "fairness" and "need," only to lose their seats after making terrible decisions.

The Democrat playbook is: change things, take from others, tax the rich, have a bigger government, have more programs, and have more policies.

The Conservative playbook is: less change, property rights, let's not intervene too much, smaller government (generally)

One is a fast death, while the latter is a slow one. Death nonetheless.

And when the US dollar loses its reserve status, the party will be over. I hope it doesn’t take all of us down too.

Examples of government waste

A Department of Agriculture report concedes that much of the $2.5 billion in "stimulus" funding for broadband Internet will be wasted.[28]

The Defense Department wasted $100 million on unused flight tickets and never bothered to collect refunds, even though the tickets were refundable.[29]

Washington spends $60,000 per hour shooting Air Force One photo-ops in front of national landmarks.[30]

Over one recent 18-month period, Air Force and Navy personnel used government-funded credit cards to charge at least $102,400 on admission to entertainment events, $48,250 on gambling, $69,300 on cruises, and $73,950 on exotic dance clubs and prostitutes.[31]

Members of Congress are set to pay themselves $90 million to increase their franked mailings for the 2010 election year.[32]

Congress has ignored efficiency recommendations from the Department of Health and Human Services that would save $9 billion annually.[33]

Taxpayers are funding paintings of high-ranking government officials at a cost of up to $50,000 apiece.[34]

The state of Washington sent $1 food stamp checks to 250,000 households in order to raise state caseload figures and trigger $43 million in additional federal funds.[35]

And the list goes on and on and on and on….

Here’s what good could have been done with that money:

raise a child

feed a child

feed x

save x

malaria pills for

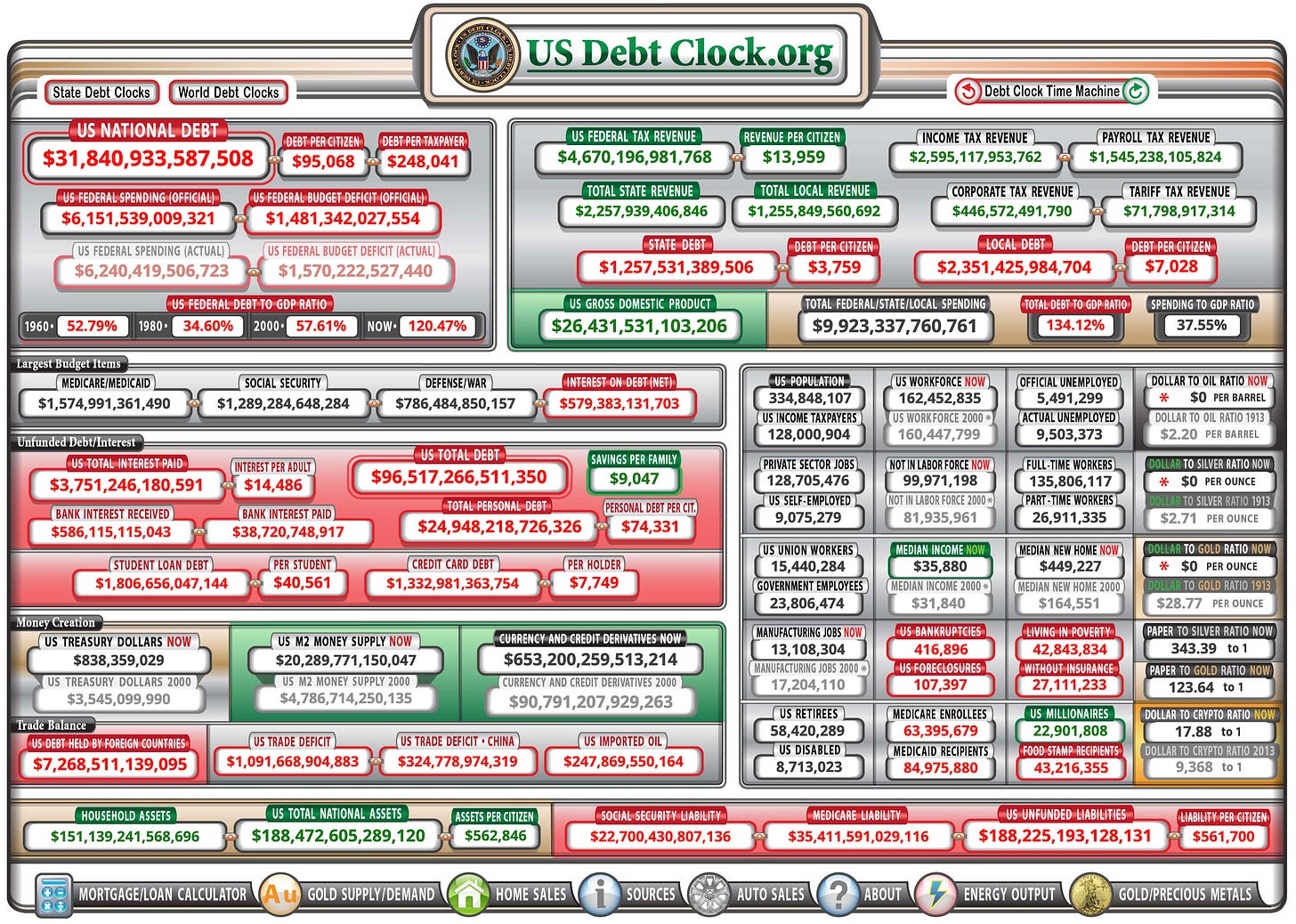

US Debt Clock

Just stare at it for a few minutes. Try to wrap your head around the scale. Here’s the website link.

Nothing the bureaucrats do will fix this 👇🏻

Inflation

Did you know that every dollar you own right now is being clipped?

Clipped is a good analogy for inflation—a bit of the value of your dollar is eroding (erosion is another apt metaphor) every day.

Whenever the FED expands the money supply through one of their many ways of doing that (QE, bank loans, helicopter money like in 2020, etc.), they steal a percentage of your purchasing power. This theft affects your held dollars and the income from our work and investments.

Inflation is theft. It’s no different than if the government drained 3% - 20% (look at the inflation we got in 2020) directly from your bank account each month.

It’s the greatest Ponzi scheme in the history of the world.

To say that World War I would have been “unaffordable” on the classical gold standard really just means that the citizens of the countries involved wouldn’t have tolerated the huge increases in explicit taxation and/or regular debt issue to pay for the conflict. Instead, to finance such unprecedented expenditures, their governments had to resort to the hidden tax of inflation, where the transfer of purchasing power from their peoples would be cloaked in rising prices that could be blamed on speculators, trade unions, profiteers, and other villains, rather than the government’s profligacy. This is why Ludwig von Mises said that inflationary finance of a war was “essentially antidemocratic.”

-Ethics of Money Production

https://twitter.com/unusual_whales/status/1661396888816615426?s=61&t=ZXi1wVLUG63SguLZQUXIpw

Inflation takes time to fully understand. Even if I map out many examples, you’ll likely not immediately grasp it without understanding basic economics (supply & demand) and the history of money.

Demand and supply

If dollars grew on trees, they would quickly lose their value, and the world would have to turn to some other form of money (Bitcoin, gold, silver). This is because the supply would be so abundant that the demand, which is inversely related, would plummet.

This is why the foundational property of sound money is its hardness, or how hard or easy it is to produce more of. In the case of gold, it’s expensive to produce and has a very predictable inflation rate of about 3% a year. This is the foundational property. It’s been humanity’s preferred form of money for the last 10,000 years. Silver is another good form of money. Seashells, not so much. Tobacco, not so much. Cigarettes if you’re in prison, but not outside in the real world.

For anything to have value, it has to be scarce, and it has to be desired.

If you’re walking through a desert and your career is down to the last drop, water quickly becomes very valuable to you. If this persists, water becomes the most valuable thing on Earth.

When you’re at home, or in most places in modern society, you might pay $1 or $2 for some water for the convenience of it, but that’s it because the supply around you is infinite.

When you increase the supply of anything, the market price drops because there is now more supply.

When you decrease the supply of something desired, the market price increases because there is now less supply.

Money is the same.

Suppose the government injects money into the economy (prints), whether it’s through quantitative easing, fractional reserve banking, or the FED’s process of giving billions to big banks at 0% interest. In that case, more money flows through the system, and as a result, prices rise.

More dollars compete for goods and services, so those prices are bid up. When fewer dollars flow through the system or technology does more with less (deflation), then prices generally come down (not always, and there are likely some exceptions here).

The US dollar is a political weapon used in geopolitics to steal from humanity. If the US prints more dollars, they’ve stolen from the purchasing power of every dollar holder and spender. That’s why they call it the “silent tax.”

It’s theft, plain and simple.

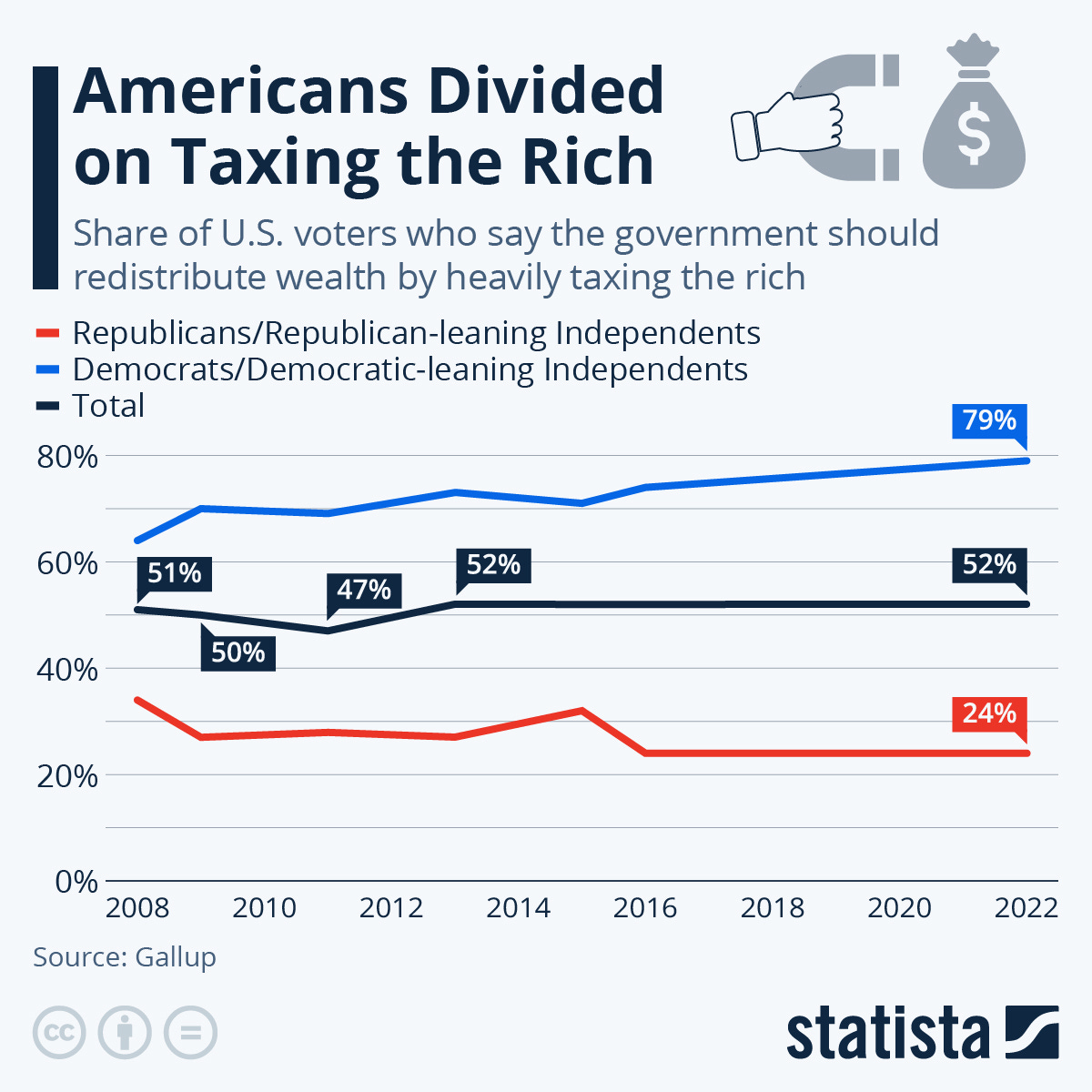

Taxing the rich

The narrative goes like this: Raise taxes on the rich, or the ultra-rich, because they can “afford it.”

Says who?

Those that have less.

Ok, let’s think about this.

So if we vote to tax the rich more, which is legalized theft, we are saying that’s okay because they have more than us.

What’s next?

Tax the rich who are a little less rich.

Ok, so we do that.

Then on and on, it goes until we have communism and millions starve due to the removal of free market forces and the abomination that is central planning.

Some of you reading this have MORE, and some have less.

So with this logic above, those with less can demand some from you while you demand some from those above. Right?

It might take 100 years, but this process will lead to the destruction of America and the likely invasion by another world power that sees us as prime pickings and wants us to destroy ourselves.

That’s one reason this is nonsense. But let’s say that doesn’t convince you because you think it’s moral to steal. After all, you believe in some weird moral justification. (BTW, this is the entire Democrat playbook, by the way.)

Instead, let’s focus on cold, hard facts.

What is the goal with raising taxes on the rich?

Let’s say the goal is to generate more taxes so we can pay for stuff for others. That’s a nice way of justifying legalized theft, but whatever.

I have to assume that raising taxes on the ultra-rich will generate more tax revenue. That’s got to be the goal, right?

Ok.

This is where it gets interesting, funny, and somewhat depressing.

Here’s the gist:

Raising taxes on the rich accomplishes the following:

Less tax revenue

lower pay for employees and fewer jobs

less innovation, investment, R&D, which leads to other countries beating us at everything

and, get this, HIGHER PRICES FOR CITIZENS

🤔

So you’re telling me that raising taxes on the rich not only DOESN’T accomplish what it intends to do, but it also has all these unintended consequences that end up affecting the lower classes?

Bingo.

And eventually, when you study these things enough, you’ll see that all state intervention does the opposite. (That topic will have to be a future episode.)

In the following sections, I’ll explain why this is the case.

Before we do that, let’s consider why politicians use this rhetoric.

Because it works.

The average person falls for many reasons I won’t get into here.

“Let’s get those greedy tax cheats.”

“Rich are greedy.”

The rich cheat, lie, and steal to get where they are.”

And so on and so forth.

It appeals to the human desire to pull down anyone above them.

And it’s been going on since the start of civilization.

No politician will run on “lower taxes for the rich,” because that sounds bad to the average person.

It’s much easier to blame the rich and make them an expedient “bad guy” for voters to latch onto.

Obama claimed he would tax the rich and give Obamacare to everyone. All he did was raise taxes on EVERYONE while contributing to the most wide-sweeping socialist implementation in American history. (Look at the medical system in this country and Big Pharma and all that bullshit to see some early signs of how broken this system is and will continue to be.)

But the reality is, if politicians want MORE TAX REVENUE so they can misspend it, they should be fighting to lower taxes on the rich. This brings in more tax revenue is because it leads to more investment.

The more capital invested in the economy the more growth we all experience and the more tax bills generated.

When you have lower taxes, you can take more risk. You can hire more people. You can file more patents. You can experiment more. And a result of this is innovation, which brings in trillions in new tax revenues.

Imagine if China was the epicenter of the Tech Boom. Imagine all that wealth if we had none of the Big Tech monopolies here. (I don’t like these companies at all, but for American dominance and tax revenues, especially, we much rather have them here than elsewhere.)

America has the world's deepest, richest, and most robust capital markets because we have the most favorable tax laws. Capital wants to come here. If you start raising taxes, you drive that capital to other markets.

That’s the short answer to why lower taxes result in more tax revenue.

Corporate tax rate increases reduce employment wages

“Any economist will tell you that corporations don’t pay taxes. They’re passed along to consumers in the form of higher prices,” says Giovanetti. “When you’re buying a car from Ford (NYSE:F), you’re paying Ford’s taxes. Business taxes are embedded in the prices of goods and services. They’re counter productive.” In other words, if you want to pay more for your next car, you should be in favor of raising taxes on the automotive industry

If a company can’t or doesn’t choose to re-locate, raising the corporate income tax hurts American employees in the form of lower wages. A national study by an economist at the Federal Reserve Bank in Kansas City, found that “a one percentage point increase in the average corporate tax rate decreases annual gross wages by 0.9 percent.”

The Tax foundation explains that in non-economic speak, “this means that a $10.4 billion increase in corporate tax collections would lower overall wages by $43.5 billion.”

Why taxing the rich lowers tax revenue

Assume your goal is to bring in more tax revenue so you can plug a few holes in your drowning tanker and live a few more years.

So you say, "Let’s tax the rich!”

“Great idea,” all your constituents say. “Get those greedy rich!”

Cept it doesn’t work.

And it causes the reverse effect—less tax revenue.

“The history of taxation shows that taxes which are inherently excessive are not paid.”

-Secretary Mellon

From 1921 until 1929, marginal tax rates shrunk from a high of 77 percent to 24 percent. Record collections of tax revenues that were so large the government almost paid off the national debt.

As for getting the wealthy to pay their fair share, in 1918, when marginal tax rates were over 70 percent, only 20 percent of taxes collected came from incomes over $300,000.

However, by 1926, 65 percent came from top earners! Mellon proved that the way to raise revenue was not to raise marginal tax rates but to lower them enough to make work and investment meaningful to wealthy people.

Every time you try to raise taxes you eventually reach a point of diminishing returns,” says Giovanetti. “It drives companies to re-located jobs and employees off-shore and it drives capitalists to move their wealth

Taxes and Leisure Time

Productive people produce less when their productivity is taxed at a higher rate.

The incentive from investment moves to conservation. It moves from hustling to enjoying life. The rich have plenty, so why would they take risks and create new value for society if the rewards don’t justify the cost?

The net result is less production, less capital movement, fewer jobs, and DING DING DING, less tax revenue.

The wealthy have enough resources. They don’t have to work. So if you incentivize them not to work, they’ll work less.

As Charlie Munger says, “Show me the incentives, and I’ll show you the outcome.”

France

In 1982, Francois Mitterand, the pioneering left-wing president of France's Fifth Republic, implemented a wealth tax. The ISF tax remained until its final abolition in 2017 by President Emmanuel Macron.

Key points include:

The ISF was levied on individuals with a net worth above €1.3m, with the tax rate fluctuating between 0.5% to 1.5% for assets over €10m.

In 2015, despite contributing to social solidarity, the ISF generated modest revenue, accounting for less than 2% of France's tax income. Around 343,000 households contributed €5.22bn, averaging €15,200 per household.

The tax drove an outflow of France's wealthiest citizens. Research from New World Wealth reveals that over 12,000 millionaires departed France in 2016. Between 2000 and 2016, a net loss of over 60,000 millionaires was recorded, causing a decline in overall tax revenue, including income tax and VAT.

French economist Eric Pichet opined that the ISF cost France almost double the revenue it generated, leading to an annual fiscal deficit of €7bn and possibly decreasing GDP growth by 0.2% annually. Additionally, ISF fraud, primarily involving property asset underestimation, was suspected of constituting about 28% of total revenues.

Another tax policy targeting the affluent, introduced by socialist President Francois Holland in 2012, was the short-lived 'supertax.' This legislation required a 75% tax on incomes over €1m, resulting in multiple French celebrities exiting the country.

France's wealth tax contributed to the exodus of an estimated 42,000 millionaires between 2000 and 2012, among other problems.

For instance, Bernard Arnault, CEO of luxury retail conglomerate LVMH Moet Hennessy Louis Vuitton, sought Belgian citizenship, and actor Gérard Depardieu relocated to Belgium, later acquiring Russian citizenship.

The tax was repealed two years post-implementation, as Macron, serving as the economic minister at the time, cautioned that it was making France "Cuba without the sun." source

Tax Failures Throughout History

Tariffs of 1828 and 1832 ("Tariffs of Abominations"): These were highly protectionist tariffs meant to protect the northern industries but were detrimental to the southern states, which relied heavily on imported goods. The taxes led to the Nullification Crisis in South Carolina and significantly contributed to the Civil War.

Luxury Tax on Yachts, Airplanes, and Expensive Automobiles (1990): Intended to raise revenue from wealthy consumers, this luxury tax decreased sales in these industries, causing job losses and industry downturns. In the case of yachts, many buyers purchased them overseas, avoiding the tax altogether. The tax was repealed mainly in 1993.

Income Tax Surcharge (1968): President Lyndon B. Johnson persuaded Congress to finance the Vietnam War by passing a 10% income tax surcharge. However, the tax was blamed for fueling inflation and was subsequently repealed in 1971.

Alternative Minimum Tax (AMT): In 1969, the AMT aimed to prevent the wealthiest from exploiting loopholes to avoid paying income tax. However, because it wasn't indexed for inflation until 2013, the tax gradually affected middle-class households. Despite reforms, the AMT is often criticized as excessively complex and failing to target the intended demographic.

Affordable Care Act's "Cadillac Tax" (2010): This 40% tax was designed to apply to high-cost employer health benefits to discourage the overuse of medical care. However, it was widely unpopular with both businesses and labor unions. It was delayed several times and eventually repealed in 2019 before it went into effect.

FINISH_ Why cutting taxes raises revenue

Taxing Wealth Is Sure-Fire Way to End Up With Less Wealthy Society

We saw above that most wealth around the world is held in businesses. When more money is left over, there is more investment and consumption, both of which stimulate economic growth.

New businesses, and sometimes, completely new markets, open up due to investing capital. This generates far more future tax revenue than if that capital were taxed regularly.

There is an easy argument to be made. One that has a lot of historical empirical support is the idea that there shouldn't be any income tax or only a small amount of it because extra money in the hands of businesspeople and investors will likely benefit society more in the long run and increase tax revenue more than the current progressive tax system.

Consumption taxes should exist so people can choose how much tax they will pay rather than be forced into it through the unconstitutional federal income tax code.

How cutting the corporate income tax brings in more tax revenue AND makes the world a better place

The simple formula for generating more tax revenue goes like this:

Less money in the hands of the government means more money in the hands of productive members of society.

The wealthy are business owners, so this means more money in the hands of businesses to use to generate more value and more profits. (All profits are taxable, mind you)

This results in more jobs, a stronger competitive edge, more innovation, more R&D, and more of everything society wants. And the result is MORE TAX REVENUE over the long run.

Evidence shows that of the different types of taxes, the corporate income tax is the most harmful for economic growth.[2] One key reason that capital is so sensitive to taxation is because capital is highly mobile. For example, it is relatively easy for a company to move its operations or choose to locate its next investment in a lower-tax jurisdiction, but it is more difficult for a worker to move his or her family to get a lower tax bill. This means capital is very responsive to tax changes; lowering the corporate income tax rate reduces the amount of economic harm it causes

A common misunderstanding is that corporations bear the cost of the corporate income tax. However, a growing body of economic literature indicates that the true burden of the corporate income is split between workers through lower wages and owners of the corporation.[3] As capital moves away in response to high statutory corporate income tax rates, productivity and wages for the relatively immobile workers fall. Empirical studies show that labor bears between 50 and 100 percent of the burden of the corporate income tax.[4] In the long run, it is split evenly by both capital and labor.[5]

There are so many empirical examples of how raising corporate taxes raises consumer prices and lowers employee wages that it's a law. So why do so many fiat economists and crony bureaucrats still use this propaganda?

Because the average voter buys it! It sounds good—tax the greedy rich, and we’ll all benefit!

However, the poor and middle classes—the very groups that this rhetoric aims to influence—are the ones who suffer the most from the effects of these bad policies.

Who woulda thought? 🤷🏻

Summary

The wealthy invest most of their wealth. These investments generate colossal tax bills. The corporations themselves pay taxes. The profit they generate is taxed. The more money they make, the more investments they make, thus the more tax generated.

On and on, the cycle of production, consumption, and the parasitic state siphoning off trillions.

Then the US government steals from us through the money printer (inflation).

As if that wasn’t enough, there’s a movement to blame the rich even though they are the ones that make all of the wealth around us possible. How bizarre is that?

To raise taxes on society's capital allocators and value creators is to raise taxes on us all. It also lowers tax revenue, stifles innovation, and makes it more likely for innocent people to die, starve, and struggle.

Obviously, the more money invested in the economy, the better off everyone is. The profit motive combined with the free market is the greatest luck to benefit the human race. The more you take that away with taxation, the more humanity suffers. It is as simple as that.